From Consultancy to Tech Firm: Can Pricepoint's Pivot Actually Work?

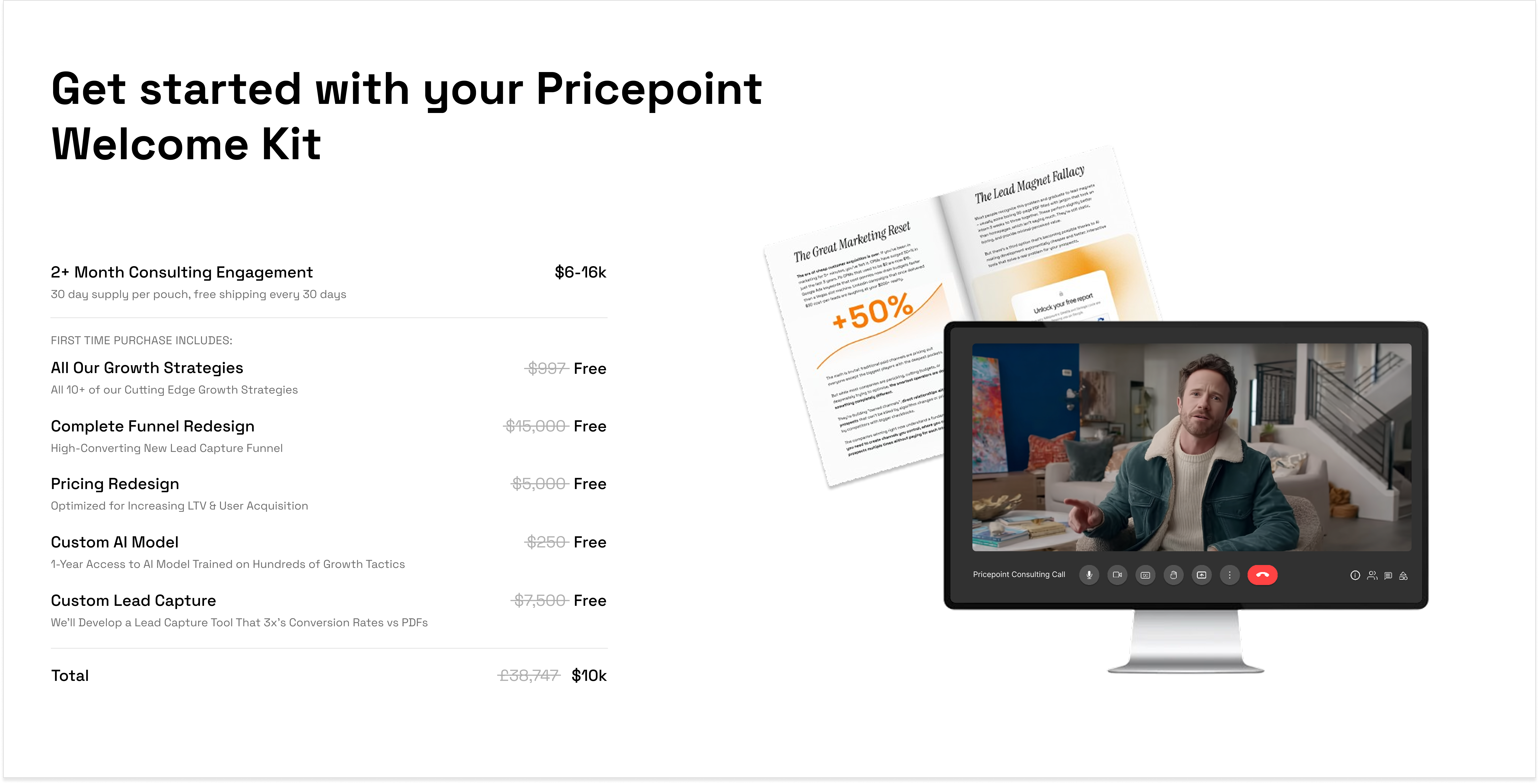

Pricepoint is giving away $25,000 worth of consulting work. For any new client who signs during their limited-time welcome offer, the B2B SaaS growth consultancy throws in comprehensive competitive intelligence reports, growth strategy overhauls, and access to their proprietary data platforms, services that would normally justify their premium hourly rates.

This isn't desperation pricing. It's predatory pricing during the most vulnerable moment the consulting industry has seen in decades.

Major consulting firms have faced significant market headwinds with declining bookings and substantial workforce reductions. The problem isn't that AI can replicate a $500,000 consultant with a single prompt, but that deep research tools have gotten remarkably capable at synthesizing information and interpreting data.

When AI handles the foundational work that junior consultants used to bill $200 per hour for, what justifies premium consulting rates?

Pricepoint's answer: proprietary data that AI can't generate because AI doesn't have access to it.

The Shift from Labor to Data

Traditional consulting firms built their value proposition on having smart people synthesize public information into strategic recommendations. Pricepoint has flipped this model entirely. Instead of selling consultant time, they're selling information asymmetry, access to competitive intelligence that other firms simply can't offer.

More importantly, they use this proprietary data to identify growth hacks that are novel and haven't been saturated by widespread adoption yet.

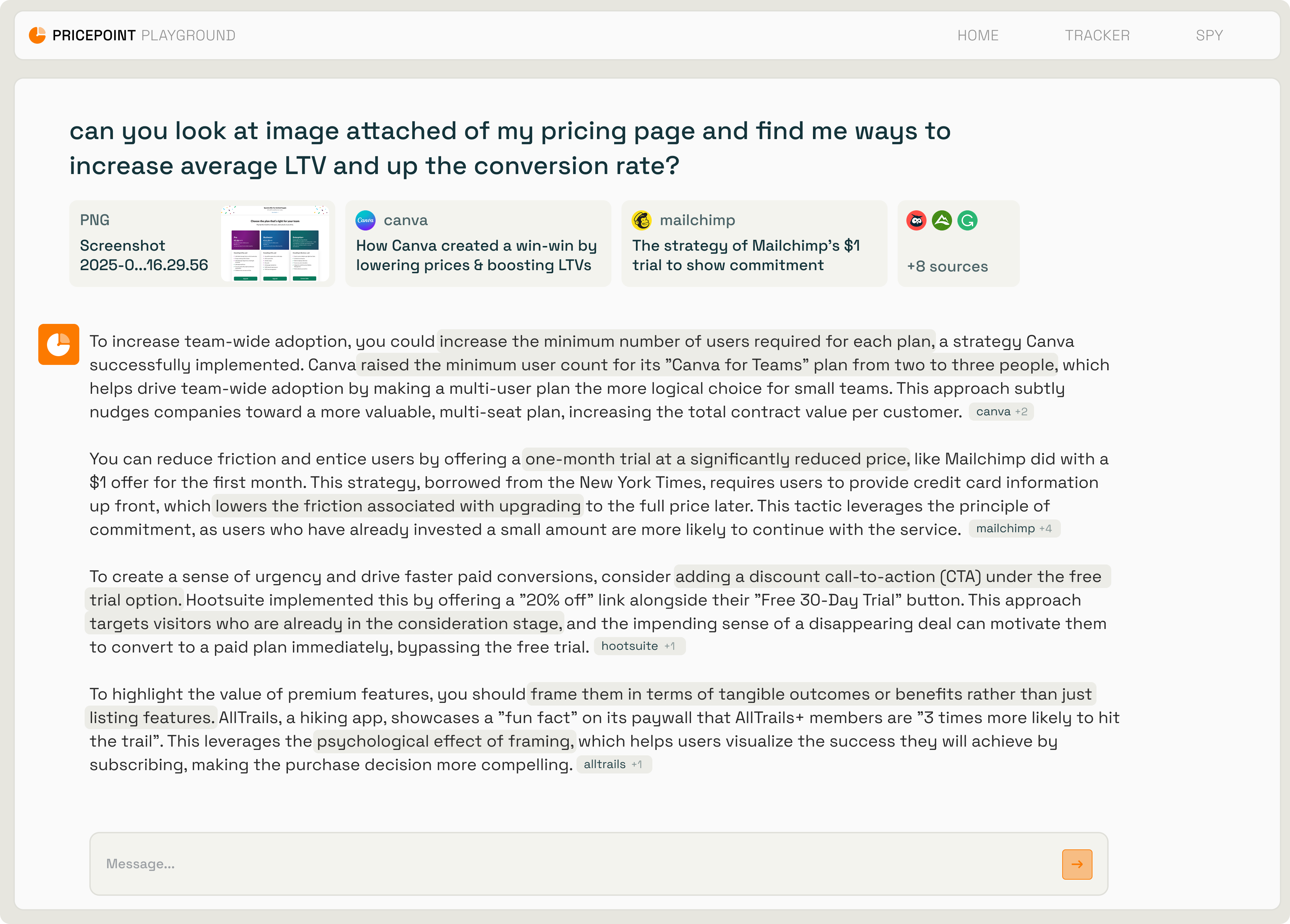

The difference becomes apparent in what new clients receive. Rather than starting with months of due diligence and analysis, Pricepoint clients get immediate access to a custom-trained AI system loaded with B2B SaaS competitive data. Upload screenshots of your product and get insights drawn from thousands of A/B tests across their client base. Ask what pricing changes to make and receive data-backed recommendations based on what similar companies actually did, not theoretical frameworks.

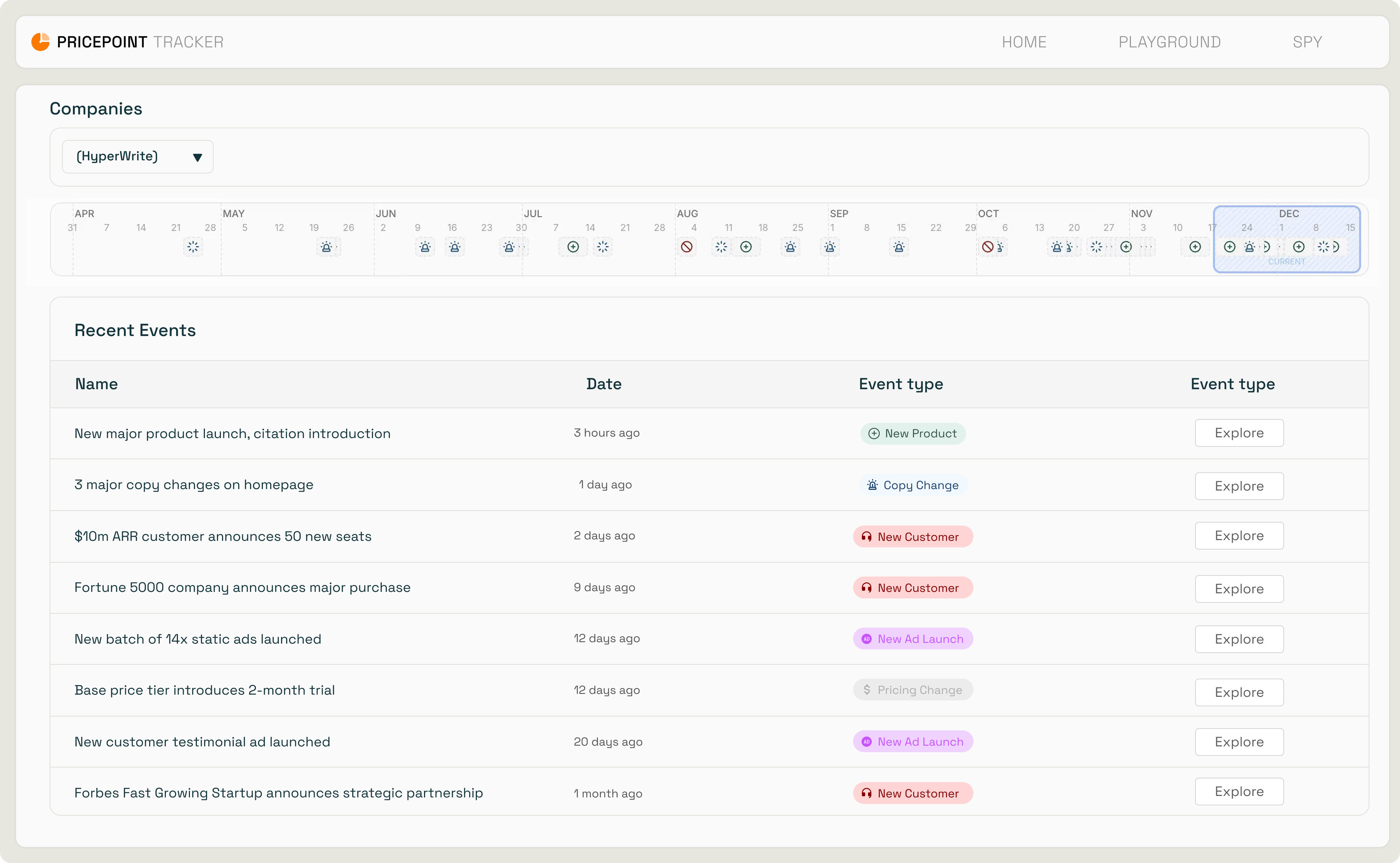

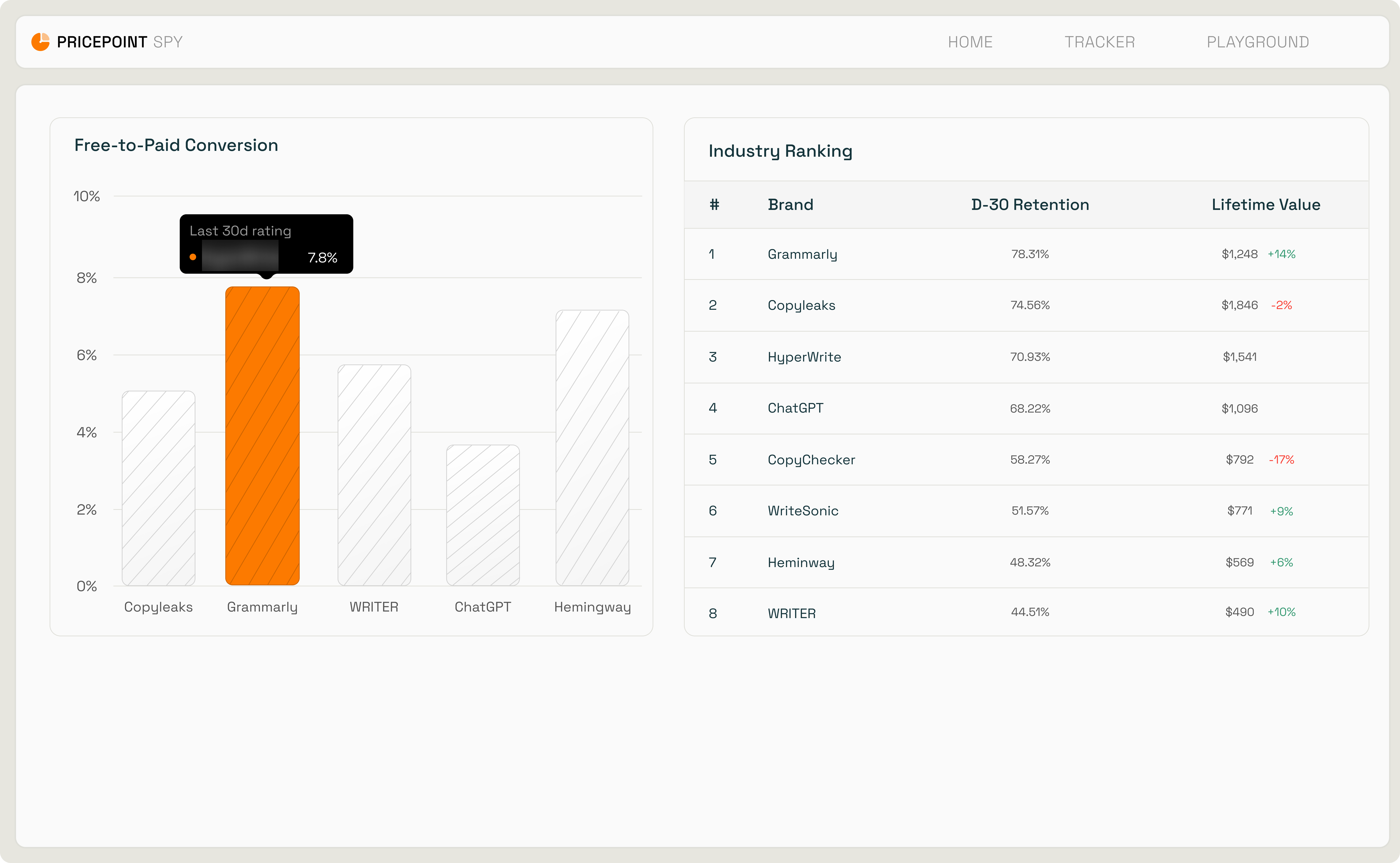

But the real differentiation lives in their data collection infrastructure. Pricepoint has built what amounts to competitive intelligence software that happens to have consultants attached. Their systems include CFO simulators trained on hundreds of software buyers' LinkedIn activity, conference presentations, and hiring patterns. Shadow NPS surveys sent to competitors' customers to identify dissatisfaction points that become cold email scripts. Scrapers that monitor competitor funnel changes, email sequences, and customer success case studies.

Clients consistently report receiving competitor LTV and churn metrics they never could have collected themselves. One showed me detailed churn analysis of a rival's customer base that Pricepoint had somehow acquired. Another had access to intent signals monitoring funding announcements and job postings at target accounts.

This represents a fundamental shift in what clients are buying. Traditional consulting sold process and thinking. Pricepoint is selling exclusive data access with consulting services layered on top.

The Counterposition Strategy

The Welcome Kit represents a sophisticated market education strategy. By demonstrating what consulting looks like when backed by proprietary competitive intelligence, Pricepoint is making traditional firms appear incomplete rather than competing on price alone. This creates a clever counterposition.

Once prospects experience growth strategies derived from unique data that reveals untapped opportunities, generic strategic advice feels inadequate. The consulting industry gets split into two categories: firms that provide insights you can't get elsewhere, and firms that provide thinking you could theoretically do yourself.

The timing amplifies this advantage. While established consulting firms struggle with AI commoditizing their research capabilities, Pricepoint is demonstrating that the solution isn't better thinking, it's better data. Their competitive intelligence systems make average consultants more valuable than brilliant ones at traditional firms. But this strategy comes with meaningful trade-offs.

The Welcome Kit essentially subsidizes customer acquisition by giving away consulting work that previously generated revenue. They're training clients to expect comprehensive solutions bundled with data access rather than paying premium hourly rates for strategic thinking alone.

The High-Stakes Retention Bet

The economics only work if clients become genuinely dependent on Pricepoint's data feeds. Traditional consulting offers clean project exits. Pricepoint creates ongoing information addiction.

Sources familiar with their client metrics suggest most customers do multiple engagements over several years. If true, the Welcome Kit becomes expensive but justified customer acquisition rather than self-destructive pricing.

The question is whether front-loading this much value creates higher lifetime relationships or just teaches prospects to expect similar bundles from competitors.

There's also the consultant capacity question. Adding a flood of new clients with extensive deliverable packages could overwhelm their team and dilute the boutique experience that justified premium positioning in the first place. Scaling data systems is straightforward. Scaling high-quality consulting relationships is not.

The Broader Implications

What Pricepoint has built only works because they serve a concentrated vertical. The unit economics of developing CFO simulators and B2B SaaS competitive intelligence don't justify themselves when you also need pharmaceutical and energy industry expertise.

Their specialization is both their opportunity and their defense against larger competitors. This suggests the consulting industry might be fragmenting rather than evolving as a unified sector.

Generalist firms get commoditized by AI handling research and synthesis. Specialist firms with vertical data advantages capture premium positioning. There's no middle ground. But here's the uncomfortable implication: Pricepoint is proving their strategy works while simultaneously showing other vertical specialists exactly what playbook to follow.

Healthcare consultants could build similar competitive intelligence for medical device companies. Financial services firms could develop proprietary data moats for fintech startups. The question isn't whether this model is replicable, it clearly is. The question is whether Pricepoint can build a substantial enough lead in B2B SaaS data collection before competitors recognize what they're actually selling.

What This Means

The consulting industry is discovering what many sectors learned during digital transformation: when technology commoditizes your core capability, you either find new defensible advantages or get squeezed toward commodity pricing. Pricepoint's approach suggests that proprietary data access might be more defensible than pure strategic thinking.

But it also demonstrates that consulting firms willing to specialize deeply in specific verticals can build genuinely differentiated offerings that traditional firms can't replicate. Whether the Welcome Kit strategy succeeds depends entirely on client retention metrics that remain proprietary.

If giving away $25,000 worth of consulting work generates multiples of that in ongoing relationships, this becomes a case study in smart customer acquisition during competitor weakness. If it trains clients to expect comprehensive solutions at discounted rates while competitors copy their data collection playbook, this becomes a cautionary tale about market education strategies that undermine your own pricing power. The consulting industry's future might depend on which scenario proves correct.